In our previous blog post on the Corporate Transparency Act (“CTA”), we introduced the CTA and gave some key takeaways for businesses and business owners to understand what is to come as it relates to complying with this new law that has been and continues to be seldom discussed. Although still hanging in the backdrop of society, the implementation date for the CTA and its regulations is now fast approaching! Here is what you should be doing now to prepare and be ready for compliance:

- Understand the Corporate Transparency Act and the Reporting Rule.

Starting January 1, 2024, every Reporting Company will be required to file with the Department of Treasury’s Financial Crimes Enforcement Network (“FinCEN”) beneficial ownership information reports (“BOI Report”) with details about the corporate entity, its Beneficial Owners, and its Company Applicants.

What Is a Reporting Company?

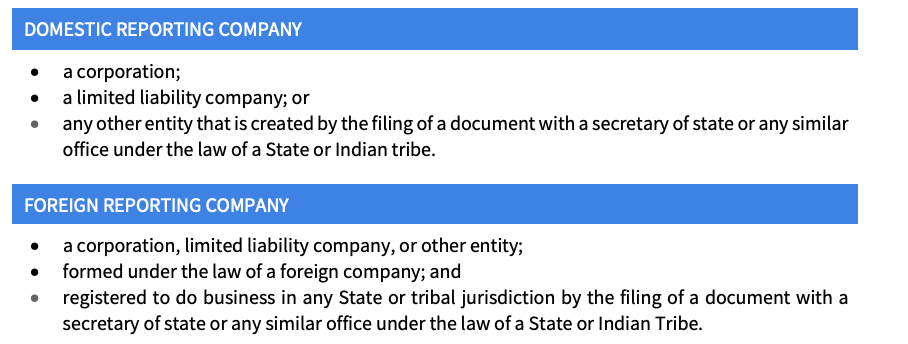

A Reporting Company can either be a Domestic Reporting Company or Foreign Reporting Company.

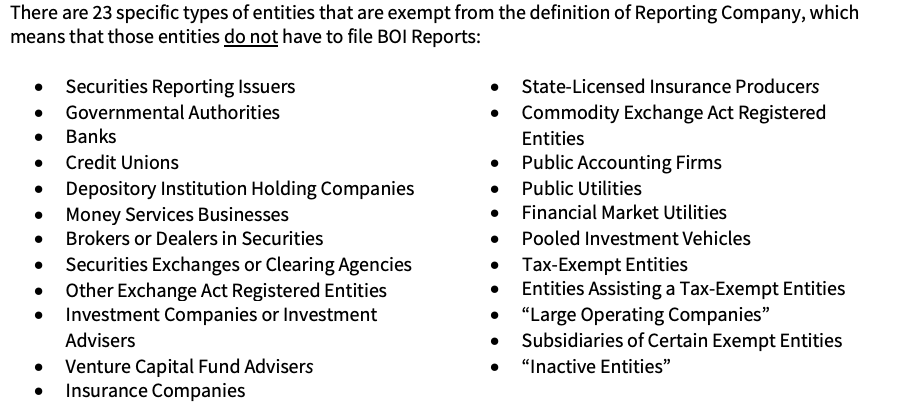

What is NOT a Reporting Company?

Who Is a Beneficial Owner?

A Beneficial Owner is any individual who, directly or indirectly, either (1) exercises substantial control over a Reporting Company or (2) has an ownership interest of at least 25% of the Reporting Company. Importantly, minor children, agents acting on behalf of an individual, employees of a Reporting Company, individuals whose only interest in a Reporting Company is through a right of inheritance, and creditors of a Reporting Company are not considered Beneficial Owners.

Who is a Company Applicant?

A Company Applicant is the individual who directly files the document that either creates or registers, as the case may be, the Reporting Company in the United States. If there is more than one individual involved in filing the documents, then the Company Applicant is the individual who is primarily responsible for directing or controlling the filing.

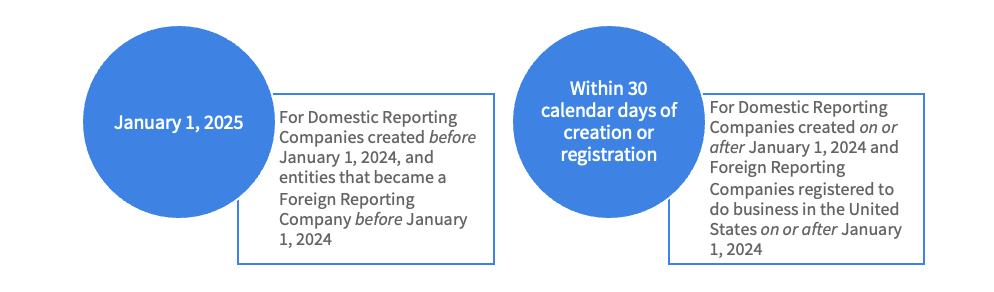

When is the First BOI Report Due?

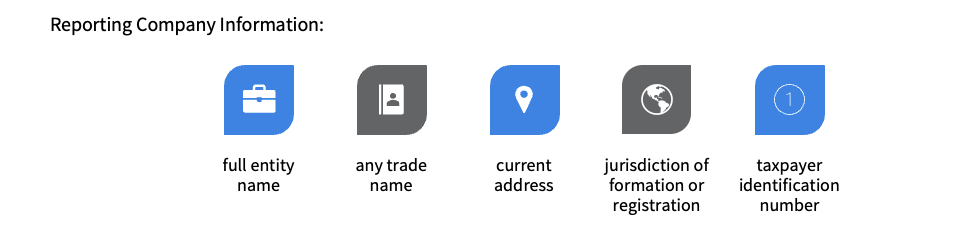

What Must be Included in the BOI Report?

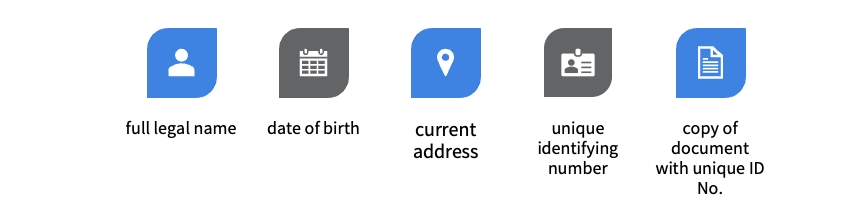

Beneficial Owner(s) and Company Applicant Information:

How are BOI Reports Filed?

FinCEN is in the process of creating the forms and systems by and through which Reporting Companies will submit BOI Reports.

What are the Ongoing Reporting Obligations?

If there is any change with respect to any information previously submitted in a BOI Report, the Reporting Company must file an updated BOI Report within 30 calendar days after the date on which such change occurs. Examples of changes that would require an updated report include changes to who is classified as a Beneficial Owner (i.e., transfers of ownership, sales of additional ownership interests, minor children reaching the age of majority), qualifying or disqualifying for an exemption, and changes to a Beneficial Owner’s name, address, or unique identifying number.

If any previously submitted BOI Report was inaccurate when filed and remains inaccurate, the Reporting Company must file a corrected report within 30 calendar days after the date on which the Reporting Company becomes aware or has reason to know of the inaccuracy.

How Can Filings be More Efficient?

To make future or frequent filings more efficient, Reporting Companies, Beneficial Owners, and Company Applicants may apply for a unique FinCEN identifier, which would be used on reports in lieu of the information detailed above. As with any reports that are required to be filed, individuals and Reporting Companies must update or correct any information that was previously submitted to FinCEN.

What are the Consequences for Failing to Comply?

If any person willfully provides, or attempts to provide, false or fraudulent beneficial ownership information or willfully fails to report complete or updated beneficial ownership information, then they may be liable for a civil penalty of $500 for each day that the violation continues or has not been remedied and may be fined up to $10,000, imprisoned for up to 2 years, or both.

- Conduct Corporate Housekeeping & Evaluate the Possibility of an Exemption.

Once you understand the Corporate Transparency Act and the Reporting Rule, you should ensure that your corporate documents are complete, finalized, and up to date, including:

Once you confirm that your corporate documents are in order, you should review the entire organizational structure to determine on an entity-by-entity basis whether an entity is a Reporting Company that is required to file a report or whether an entity qualifies or could potentially qualify for an exemption.

- Determine Who Your Beneficial Owners Are & Gather Information for the BOI Report.

If it is determined that your company is a Reporting Company, you will need to review your corporate documents and structure to determine who the Beneficial Owners are and how they maintain their ownership interests and/or control over the company. When your Beneficial Owners are identified, you should begin the process of obtaining the information for each BOI Report. Any information gathered that is related to your Beneficial Owners should be stored in a secure location or on a secure system.

As you are working to understand the requirements of the CTA, conducting your corporate housekeeping, evaluating the possibility of an exemption, and determining who your Beneficial Owners are, we are here to help and guide you. We will work with you to analyze whether or not your company is a Reporting Company, and we will review your corporate documents and structure to identify your Beneficial Owners for whom information must be reported. Contact us today so that we can begin working with you to ensure you are prepared and ready to comply with the CTA.